How to Know if You Have Arthritis, and What to Do About It

Arthritis is commonly associated with people of a, "certain age." And is a general term often used to cover a number of issues. But what is it...

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

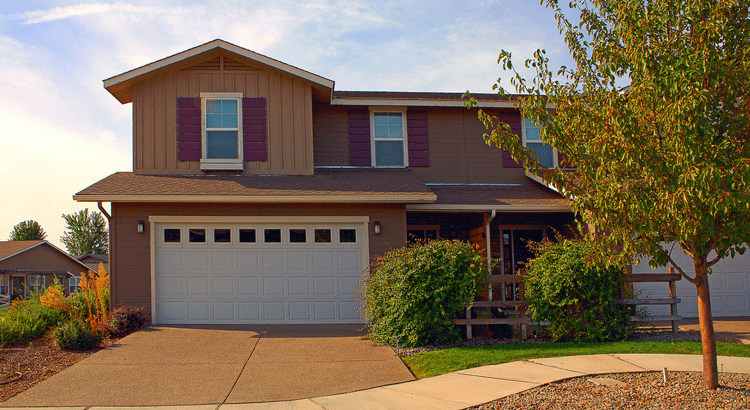

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

Arthritis is commonly associated with people of a, "certain age." And is a general term often used to cover a number of issues. But what is it...

With rising home prices and volatile mortgage rates, it’s important you know about every resource that could help make buying a home possible. And...

Do your 2025 plans involve looking for a job? Whether you are new the work force or a seasoned professional looking for a change, some of the ways...

The inability to sleep well can be extremely frustrating, and can add to health issues. The stress of the holiday season tends to exacerbate any...

Financial experts generally agree it is best not to touch your 401(k) until you are in your retirement years. But there can be times when it is...

The benefits of walking have been well established. It is an easy, healthy way to get exercise for all fitness levels. But what are the pros and cons...

The holiday season is here, and you know what that means. It’s time to shop ‘til you drop! But if you’re not careful, you could spend more than you...

There are more homes on the market right now than there have been in years – and that could be a game changer for you if you’re ready to buy. Let’s...

Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth.

According to a study done by the Federal Reserve, the number of checks written by consumers, businesses, and government entities dropped by 7.2% a...

Navigating the mortgage process can feel overwhelming, but having the right documents ready can make all the difference—here’s all the documents you...

Looking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when...

Manage your accounts, make payments, and more.

Open an account with us.