The Perks of Buying a Fixer-Upper

There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner.

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

1 min read

First Federal Bank : July 12, 2024 8:19:55 AM EDT

Everyone’s vision for the future is personal and unique. For many, common goals include success, freedom, and prosperity — values closely tied to having your own home and the iconic feeling of achieving the American Dream.

For many, common goals include success, freedom, and prosperity — values closely tied to having your own home and the iconic feeling of achieving the American Dream.

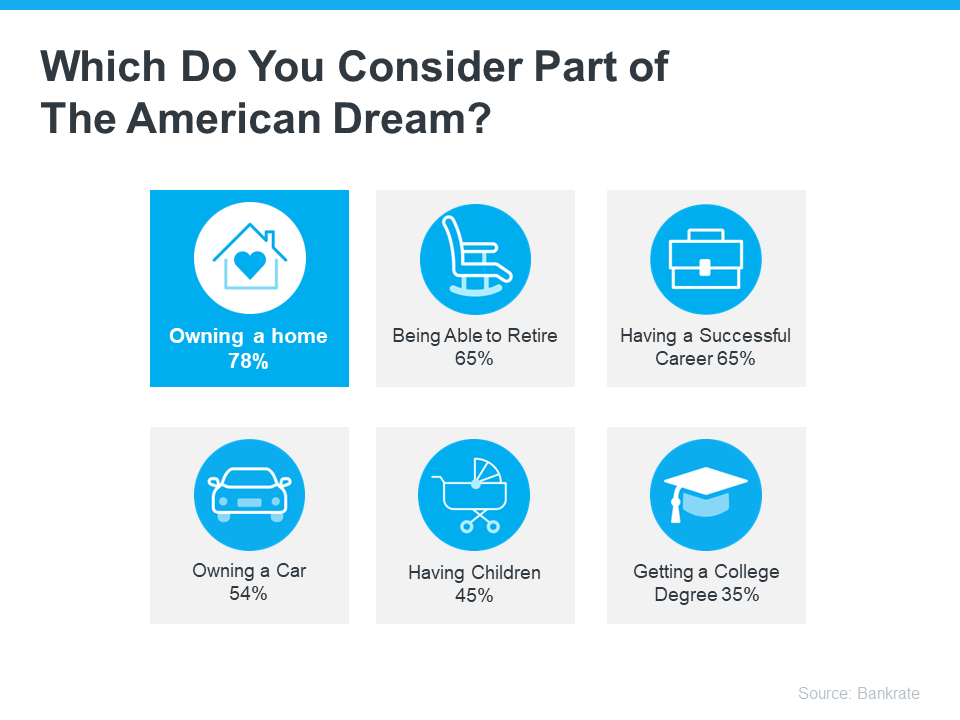

A recent survey by Bankrate reveals exactly that: homeownership is still a part of the American Dream. The results show, at 78%, that owning a home tops the list, surpassing other significant milestones such as retirement, having a successful career, and more (see below): So, why is buying a home important to so many today? One reason is the financial and physical security it provides. Many people see homeownership as a way to reduce stress because owning a home with a fixed-rate mortgage stabilizes what is likely their largest monthly expense.

So, why is buying a home important to so many today? One reason is the financial and physical security it provides. Many people see homeownership as a way to reduce stress because owning a home with a fixed-rate mortgage stabilizes what is likely their largest monthly expense.

Another factor is the potential for building wealth. That’s because, over time, homeowners gain equity as they pay down their mortgage and as home prices appreciate, leading to longer-term financial stability.

But what about the responsibilities that come with owning and maintaining a home? According to a survey by Entrata, only 23% of renters feel homeownership is too much work, indicating the majority are open to the commitments and obligations that come with being a homeowner.

While buying a home today might seem daunting due to higher mortgage rates and rising home prices, the long-term benefits can make it worthwhile. If you’re considering homeownership, remember that it's more than just a financial investment — it's a step toward securing your future.

Owning a home is a significant and powerful decision that represents a big part of the American Dream. If you’re ready to take this step, connect with a First Federal Bank Loan Officer, so you have someone who can guide you through the process and help you make your homeownership goals a reality.

There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner.

Depending on where you live, the housing market could feel red-hot or strangely quiet right now. The truth is, local markets are starting to move in...

It feels like everything is getting more expensive these days. That’s because inflation has remained higher than normal for longer than expected –...

Manage your accounts, make payments, and more.

Open an account with us.