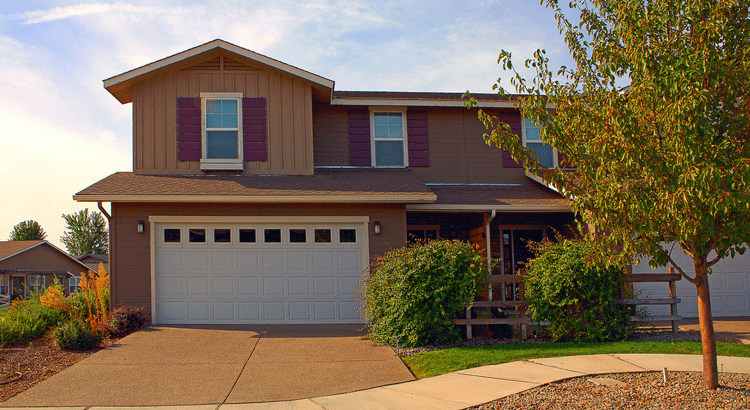

Buying a Home May Help Shield You from Inflation

It feels like everything is getting more expensive these days. That’s because inflation has remained higher than normal for longer than expected –...

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

It feels like everything is getting more expensive these days. That’s because inflation has remained higher than normal for longer than expected –...

There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner.

Have you been wondering whether you should keep renting or finally make the leap into homeownership? It’s a big decision, and let’s be real — renting...

It’s no secret that affordability is tough, given the current mortgage rates and home prices. And that may have you worried about how you’ll be able...

It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out...

This is the time when a lot of people take a moment to reflect and set their goals for this year. And as you picture what you want your 2025 to look...

Have you ever thought about packing up and moving to be closer to the people who mean the most to you? Maybe you’re tired of long drives to see your...

When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders...

Today’s mortgage rates and home prices may have you second-guessing whether it's still a good idea to buy a home right now. While market factors are...

Chances are you’re hearing a lot about mortgage rates right now, and all you really want to hear is that they’re coming back down. And if you’ve seen...

With rising home prices and volatile mortgage rates, it’s important you know about every resource that could help make buying a home possible. And...

There are more homes on the market right now than there have been in years – and that could be a game changer for you if you’re ready to buy. Let’s...

Manage your accounts, make payments, and more.

Open an account with us.