From Frenzy to Breathing Room: Buyers Finally Have Time Again

If you tried to buy a home a few years ago, you probably still remember the frenzy. Homes were listed one day and gone the next. Sometimes it only...

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

If you tried to buy a home a few years ago, you probably still remember the frenzy. Homes were listed one day and gone the next. Sometimes it only...

Mortgage rates are still a hot topic – and for good reason. After the most recent jobs report came out weaker than expected, the bond market reacted...

Are you wondering if you’re on track to retire someday?

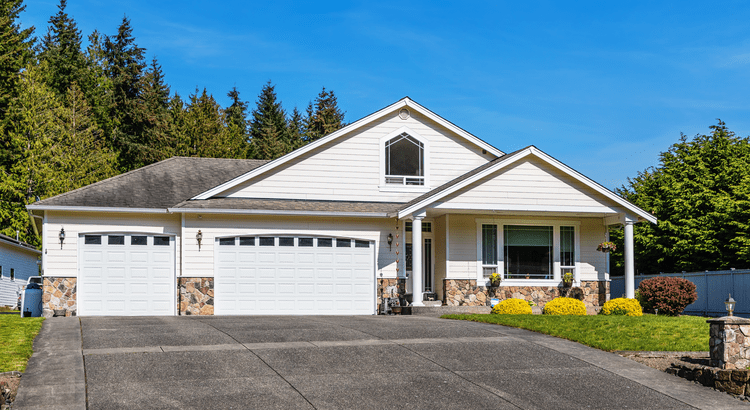

Depending on where you live, the housing market could feel red-hot or strangely quiet right now. The truth is, local markets are starting to move in...

Over the past few years, affordability has been the biggest challenge for homebuyers. Between rapidly rising home prices and higher mortgage rates,...

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to...

Here’s something you need to know. The housing market is getting back to a healthier, more normal place. And even though it may not sound like it,...

Are you thinking about buying a home, but not sure if now’s the right time? A lot of people are waiting and wondering what the market’s going to do...

You’ve probably asked yourself lately: Is it even worth trying to buy a home right now?

Do you think a brand-new home means a bigger price tag? Think again.

Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one...

Manage your accounts, make payments, and more.

Open an account with us.