The Benefits of Battery-Powered Lawn Tools

From cutting grass and whacking weeds, to blowing leaves and trimming hedges, keeping your lawn looking its best can take up a lot of time and...

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

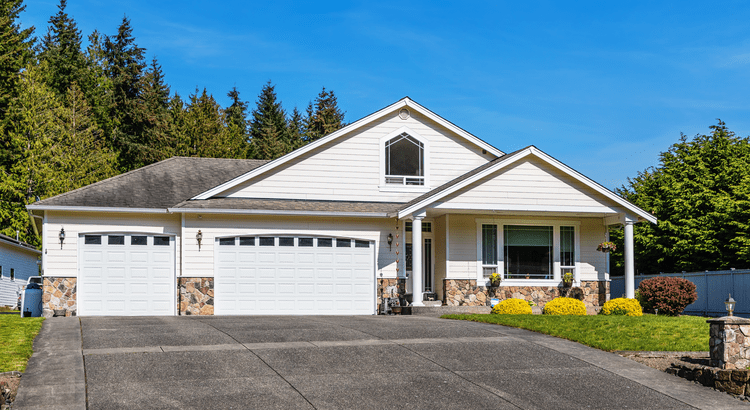

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

A durable power of attorney is a powerful and important tool for estate planning. It is, however, only one of four main types of powers of attorney. Before exploring what makes the durable power of attorney unique, it’s important to understand the other options.

A durable power of attorney is a powerful and important tool for estate planning. It is, however, only one of four main types of powers of attorney. Before exploring what makes the durable power of attorney unique, it’s important to understand the other options.

What is a power of attorney?

A power of attorney is a legal document allowing you to appoint another person to take control of your affairs. Effectively, it gives them the authority to act on your behalf. “The person who gives the authority is called the principal, and the person who is given authority is called the agent or the attorney-in-fact,” explains Edward A. Haman, author of over a dozen self-help legal books.

With only a few legal exceptions, a power of attorney can give an agent the right to do any legal act that the principal could do themselves.

Limited vs. general power of attorney

Powers of attorney fall under two broad categories: limited and general.

With a limited power of attorney, also known as a special power of attorney, you grant an agent the authority to act only in a limited situation specified in the document. The document will typically also specify when this authority ends. For example, this can be used when you are unable to be present for the signing of a contract and therefore need an agent to legally act on your behalf. You could give someone the right to sign a deed to property for you on a specific day, and that would be the limit of your agent’s power.

A general power of attorney is a lot more comprehensive, giving the agent all of the same rights and powers that you have. They can manage your investments, operate your business, handle your taxes, buy or sell property and even apply for government benefits. A general power of attorney ends only when you rescind it, when you die or when you become incapacitated.

Durable power of attorney

A durable power of attorney is a subtype of power of attorney that can be either limited or general. What makes it different is that it remains in effect even after you are incapacitated. “There is language within the legal document providing that this power extends to your agent even in the event you become incapacitated and unable to make decisions for yourself,” writes Michelle Kaminsky, Esq.

This gives someone the authority to act on your behalf if you become temporarily or even permanently unable to make decisions, such as after a stroke or while suffering from dementia.

There are two types of durable powers of attorney, which limit the scope of your agent’s authority: financial and medical. Kaminsky explains that a financial power of attorney gives your agent the authority to manage your financial affairs, while a medical power of attorney gives them the authority to make medical decisions, both in the event that you are unable to do so yourself.

It can be useful to separate financial and medical powers of attorney because, for example, while your spouse may be well suited to making medical decisions for you, your business partner would be better suited to making the business decisions.

How do you create a durable power of attorney?

To create a durable power of attorney, you must first demonstrate you are of sound mind. While it is best to have a durable power of attorney long before any issue of a cognitive nature arises, this is not a requirement. “A person can be suffering from dementia or Alzheimer's disease or be otherwise of limited mental capacity sometimes but so long as they have a lucid moment and know what they are doing at the moment they sign the Power of Attorney, it is valid, even if later they don't remember signing it,” says Timothy L. Takacs, certified elder law attorney.

The legal document granting durable powers of attorney typically only differs from that of a regular power of attorney in that it includes a passage stating that disability, incapacity or incompetence does not revoke it. According to Haman, many states have an officially recognized form for both financial and medical powers of attorney and will include the necessary language. However, it is important you ensure any form you use complies with the requirements of the law in your state.

The durable power of attorney is a very effective tool you can use to help manage your estate if you expect to become incapacitated, particularly in the later stages of your life. However, remember that your death always ends a power of attorney, durable or not. To manage your estate after death, better tools exist, such as establishing a will and setting up beneficiaries.

From cutting grass and whacking weeds, to blowing leaves and trimming hedges, keeping your lawn looking its best can take up a lot of time and...

Social media is a powerhouse in today’s society. With the right platform, you can easily connect with customers all across the globe, giving you...

Are you thinking about buying a home, but not sure if now’s the right time? A lot of people are waiting and wondering what the market’s going to do...

Manage your accounts, make payments, and more.

Open an account with us.