The Return to Urban Living — Why More People Are Moving Back to Cities

After years of suburban and rural migration during the pandemic, cities have been making a comeback in the past couple of years. According to the ...

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

2 min read

First Federal Bank : November 27, 2023 1:11:10 PM EST

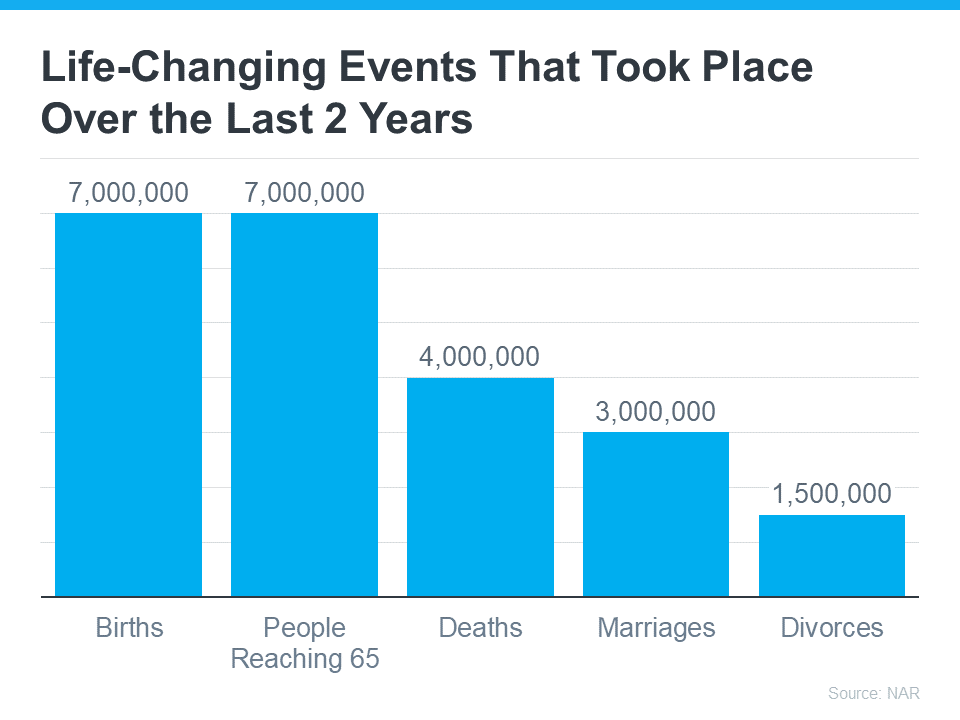

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and starting a new adventure, or the bittersweet feeling of an empty nest. If something like this is changing in your own life, you may be considering buying or selling a house. That’s because through all these life-altering events, there is one common thread—the need to move.

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and starting a new adventure, or the bittersweet feeling of an empty nest. If something like this is changing in your own life, you may be considering buying or selling a house. That’s because through all these life-altering events, there is one common thread—the need to move.

And, these big life changes are going to continue to impact people moving forward, even with the current affordability challenges brought on by higher mortgage rates and rising home prices.

And, these big life changes are going to continue to impact people moving forward, even with the current affordability challenges brought on by higher mortgage rates and rising home prices.

As Claire Trapasso, Executive News Editor at Realtor.com, says:

"Because high mortgage rates, elevated home prices, and stubbornly low inventory make today's housing market particularly challenging, many of today's buyers are motivated by life changes, such as growing families, supporting elderly parents or grown children, or accommodating professional needs. . .”

When it comes to buying a home, the desire for more space due to a new addition may be a top concern. However, rising home prices and mortgage rates can make the process challenging. Despite this, it is important to find a way to meet your changing needs, even in today's market.

Fortunately, one our skilled mortgage loan officers can provide valuable assistance. Their extensive knowledge of the local housing market can save you time and alleviate stress. They will take the necessary steps to comprehend your specific requirements, financial situation, and preferences. This enables them to streamline your search and offer appropriate loan options.

When you are selling a house, especially if you are retiring or going through a separation or divorce, your main goal is to maximize your investment and find a better home for your future. This is where the expertise of a mortgage loan officer can really make a difference. They can offer valuable information about the current market conditions, help you understand the financial impact of selling your home, and even assist potential buyers in getting financing.

Regardless of your circumstances, it is important to rely on a trustworthy professional to guide you through the process of buying or selling a home.

If recent events in your life have left you with the desire or necessity to move, make sure to get in touch with a Loan Officer at First Federal Bank today!

After years of suburban and rural migration during the pandemic, cities have been making a comeback in the past couple of years. According to the ...

Renting can feel much less expensive and much simpler than buying a home, especially right now. No repairs, no property taxes, no worrying about...

Manage your accounts, make payments, and more.

Open an account with us.