Tips for Buying a Home in Another State

Buying real estate far from your current residence can be tricky. Typically, you don’t have the luxury to get truly familiar with the new area — and...

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

2 min read

First Federal Bank : October 3, 2025 8:00:01 AM EDT

If you’re planning to buy a home

this year, there’s one expense you can’t afford to overlook: closing costs.

Almost every buyer knows they exist, but not that many know exactly what they cover, or how different they can be based on where you're buying. So, let’s break them down.

Your closing costs are the additional fees and payments you make when finalizing your home purchase. Every buyer has them. According to available data from Freddie Mac, they typically include things like homeowner insurance and title insurance, as well as various fees for your:

When you search for information about closing costs online, you’ll often see a national range, usually 2% to 5% of the home’s purchase price. While that’s a useful starting point if you’re working on your homebuying budget, it doesn’t tell the whole story. In reality, your closing costs will also vary based on:

While the home price is obviously going to matter, state laws, tax rates, and even the going costs for title and attorney services can change what you expect to pay. That’s why it's important to talk to the pros ahead of time so you know what to budget for. Knowing these costs may help you feel more prepared before you begin shopping.

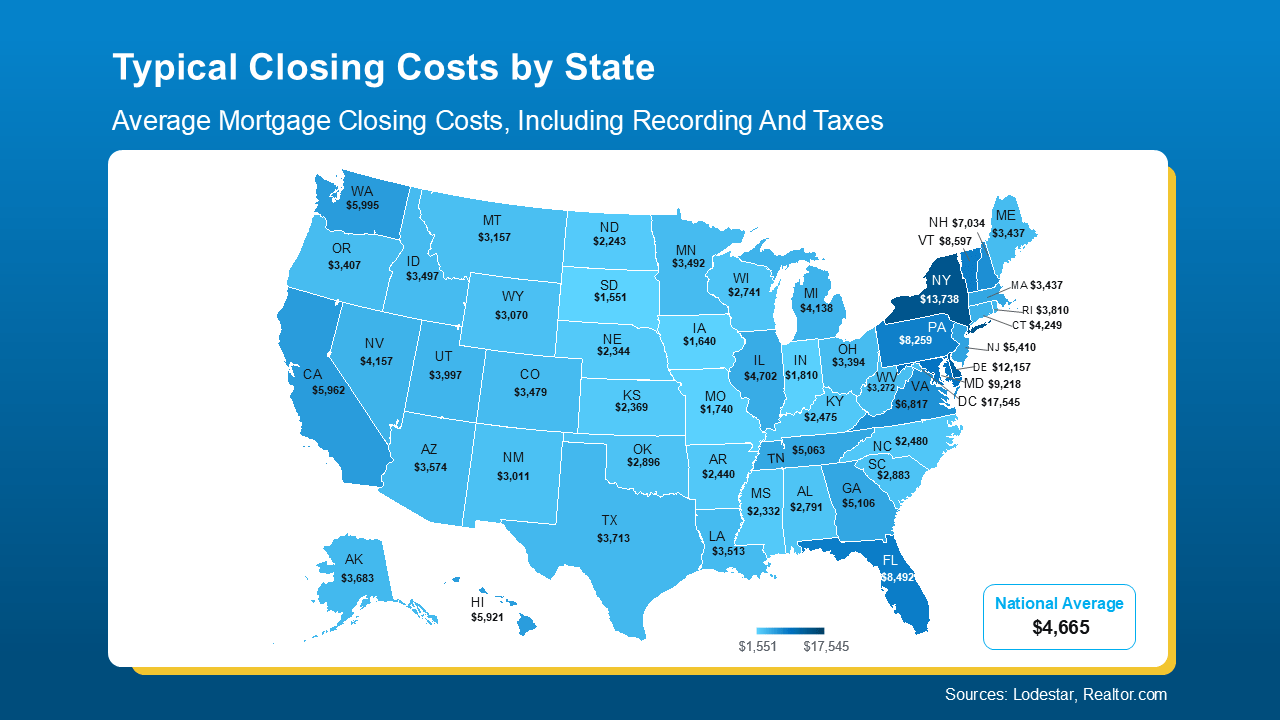

To give you a rough ballpark, here’s a state-by-state look at typical closing costs right now based on those factors for the median-priced home in each state (see map below):

Source: Loadestar Data Reports, 2025 Purchase Mortgage Closing Cost Data Report, September 2025

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

If you want a real number to help with your budget, your best bet is to talk to a local agent and a lender. They can run the math for your price range, loan type, and exact location.

And just in case you’re looking at your state’s number and wondering if there’s any way to trim that bill, NerdWallet (source: Nerdwallet, Mortgage Closing Costs: How Much You’ll Pay, September 2025) shares a few strategies that can help:

Closing costs are a key part of buying a home, but they can vary more than most people realize. Knowing your numbers (and how to potentially bring them down) can go a long way and help you feel confident about your purchase. One option is to speak with a First Federal Bank Loan Officer, who can provide a personalized estimate, if you choose.

Buying real estate far from your current residence can be tricky. Typically, you don’t have the luxury to get truly familiar with the new area — and...

Over the past few years, affordability has been the biggest challenge for homebuyers. Between rapidly rising home prices and higher mortgage rates,...

If your business has grown to operating in more than one state, you will need to file taxes for each location. Doing so can be tricky, but knowing...

Manage your accounts, make payments, and more.

Open an account with us.