3 min read

Why More Homeowners Are Giving Up Their Low Mortgage Rate

First Federal Bank : December 12, 2025 8:00:01 AM EST

If you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair. That rate has been one of your best financial wins – and it can be hard to let go. But here’s what you need to remember...

you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair. That rate has been one of your best financial wins – and it can be hard to let go. But here’s what you need to remember...

A great rate won’t make up for a home that no longer works for you. Life changes, and sometimes, your home needs to change with it. And you’re not the only one making that choice.

The Lock-In Effect Is Starting To Ease

Many homeowners have been frozen in place by something the experts call the lock-in effect. That's when you won't move because you don’t want to take on a higher rate on your next home loan. But data from Federal Housing Finance Agency (FHFA) shows the lock-in effect is slowly starting to ease for some people.

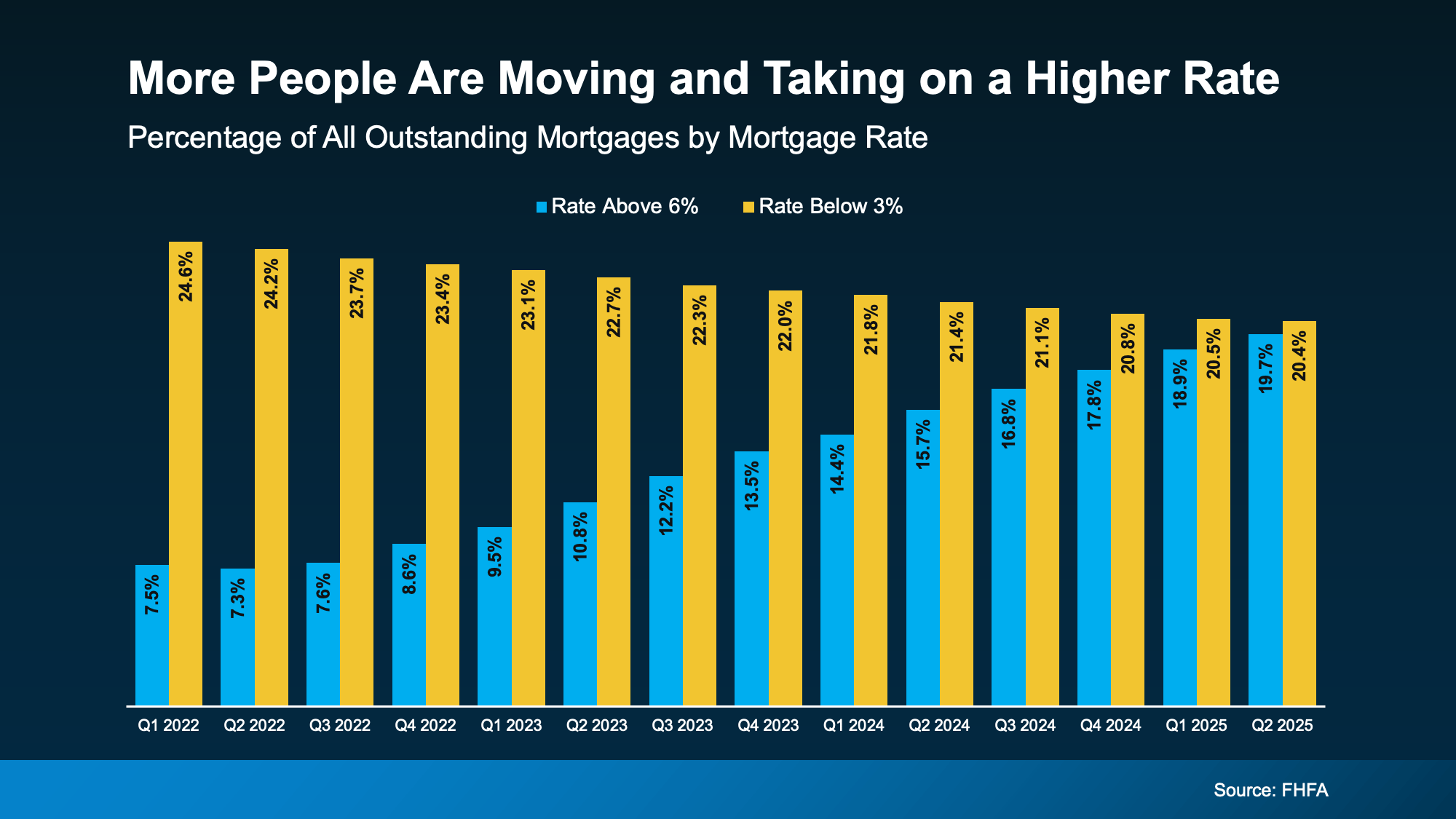

The share of homeowners with a mortgage rate below 3% (the yellow in the graph below) is slowly declining as more people move. And while some of the people with a rate over 6% are first-time buyers, the number of homeowners with a rate above 6% (the blue) is rising as some choose to move despite higher rates.

Source :https://www.fhfa.gov/data/dashboard/nmdb-outstanding-residential-mortgage-statistics, December 2025

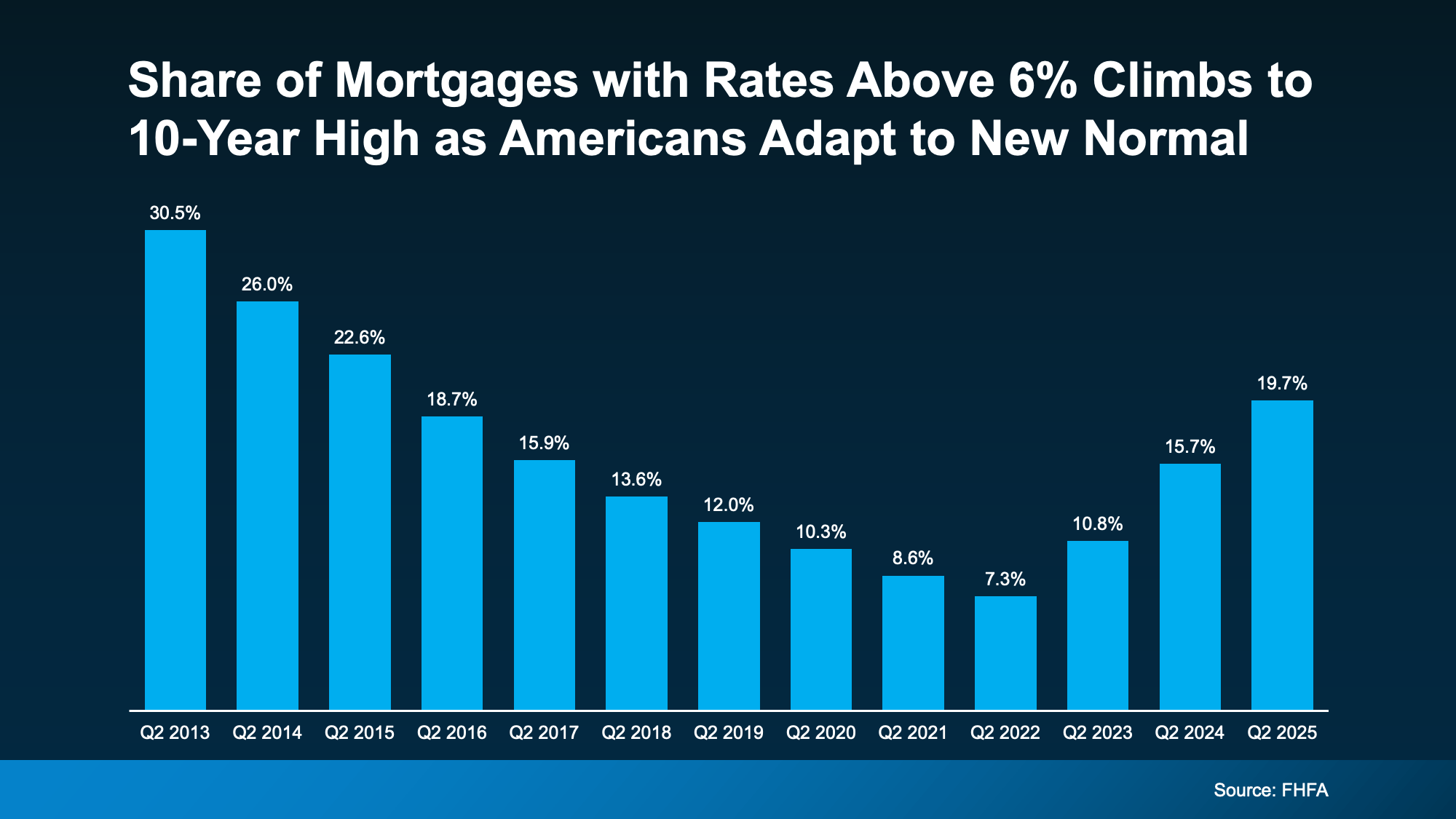

And while it may not seem that dramatic, it’s actually a pretty noteworthy shift. The share of mortgages with a rate above 6% just hit a 10-year high (see graph below). That shows more people are getting used to today’s rates as the new normal.

Why A

Source: https://www.fhfa.gov/data/dashboard/nmdb-outstanding-residential-mortgage-statistics, December 2025

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

It’s simple. Sometimes they can’t put their life on pause anymore. Families grow, jobs change, priorities shift, and a house that once fit perfectly may not fit at all anymore – no matter how good their rate was. And that’s okay. As Chen Zhao, Head of Economic Research at Redfin (RedfinNews, Share of Mortgages with Rates Above 6% Climbs to 10-Year High as Americans Adapt to New Normal, December 2025), explains:

“More homeowners are deciding it’s worth moving even if it means giving up a lower mortgage rate. Life doesn’t standstill—people get new jobs, grow their families, downsize after retirement, or simply want to live in a different neighborhood. Those needs are starting to outweigh the financial benefit of clinging to a rock-bottom mortgage rate.”

First American (Source: The REconomy Podcast™: Why Life Events Still Drive Home-Buying Demand Despite Affordability Challenges, December) refers to these life motivators as the 5 Ds:

- Diplomas: People with college degrees typically earn more, and that adds up to more buying power. Maybe you bought your house when you were younger and now that you’ve graduated and have a rising career, you’re ready to move up.

- Diapers: You’ve outgrown your space. A growing baby may prompt the need for additional space or a different home layout.

- Divorce: Whether it’s ending a marriage (or starting one), changes in household structure often influence housing needs.

- Downsizing: You’re ready to downsize. Some homeowners choose a smaller home for easier maintenance or lifestyle changes.

- Death: If you’ve recently lost a loved one, family-related changes can shift priorities around location or home size.

Whatever your reason, here’s what you need to consider. Yes, your low rate is great. But staying put may or may not align with your current goals, and evaluating your needs can help clarify your next steps.

According to Realtor.com, nearly 2 in 3 potential sellers have already been thinking about moving for over a year. That’s a long time to press pause on your plans. On your needs. On your family’s goals. So, maybe the question isn’t: “Should I move?”

It’s actually: “How much longer am I willing to stay somewhere that no longer fits my life?”

Because we’ve already seen rates come down from their peak earlier this year. Some industry forecasts suggest they may ease in 2026, though this cannot be guaranteed. When you stack that on top of the very real reasons you may need a new home, it may be a good time to explore your options and gather more information.

Bottom Line

While mortgage rates are important, so are your lifestyle needs and long-term goals.

With mortgage rates down from their peak, and with some forecasts suggesting they may ease in 2026 (not guaranteed), moving may be more feasible than you think. If you’re ready to see what’s possible in our market, connect with a First Federal Bank Loan Officer today.

Patience Won’t Sell Your House. Pricing Will.

Waiting for the perfect buyer to fall in love with your house? In today’s market, that’s usually not what’s holding things up. And here’s why.

More Homes, Slower Price Growth – What It Means for You as a Buyer

There are more homes on the market right now than there have been in years – and that could be a game changer for you if you’re ready to buy. Let’s...