4 Reasons Your House Is High on Every Buyer’s Wish List This Season

When the holidays roll around, travel plans, family gatherings, and all the chaos of the season may make you think it’s better to pull your listing...

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

2 min read

First Federal Bank : September 12, 2025 7:45:00 AM EDT

If your selling strategy still assumes you’ll get multiple offers over asking, it’s officially time for a reset. That frenzied seller’s market is behind us. And here are the numbers to prove it.

get multiple offers over asking, it’s officially time for a reset. That frenzied seller’s market is behind us. And here are the numbers to prove it.

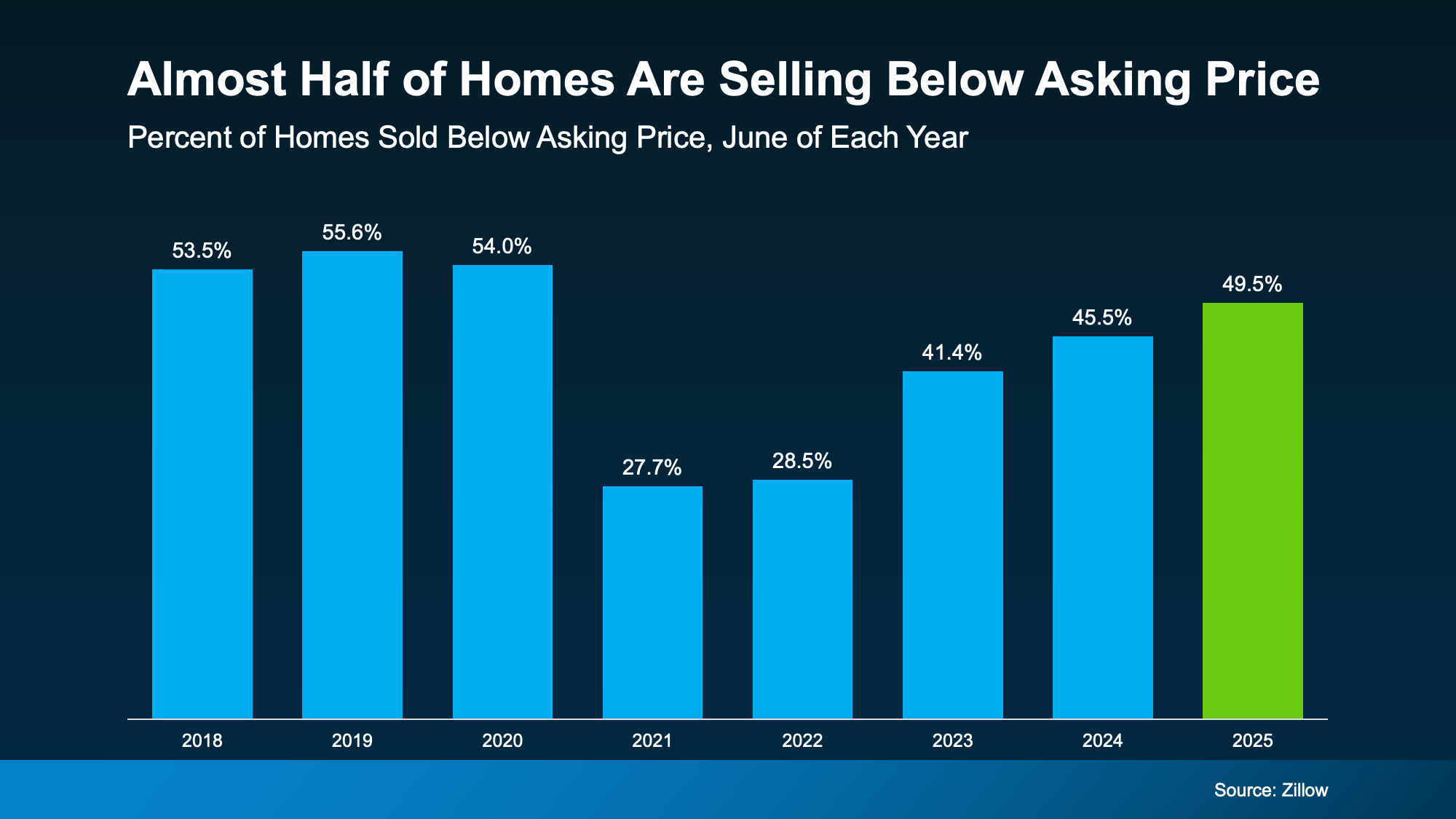

Right now, about 50% of homes on the market are selling for less than their asking price, according to the latest data from Zillow.

But that isn’t necessarily bad news, even if it feels like it. Here’s why. The wild run-up over the last few years was never going to be sustainable. The housing market needed a reset, and data shows that’s exactly what’s happening right now.

The graph below uses data from Zillow to show how this trend has shifted over time. Here’s what it tells us:

In this return to normal, your pricing strategy is more important than ever.

A few years ago, you could overprice your house and still get swarmed with offers. But now, buyers have more options, tighter budgets, and less urgency.

Today, your asking price may significantly affect your chances of sale, especially right out of the gate. The first two weeks often see the most buyer activity, so accurate pricing during that time can be important. Buyers will look right past it. And once your listing sits long enough to go stale, it’ll be hard to sell for your asking price.

Basically, sellers who cling to outdated expectations may face longer time on the market, or need to adjust pricing. But homeowners who understand what's happening are still winning, even today.

Because that stat about 50% of homes selling for under asking also means the other half are selling at or above – as long as they're priced right from the start.

So, how do you set yourself up for success? Do these 3 things:

If you want your house to be one that sells for at (or even more than) your asking price, it’s time to plan for the market you’re in today – not the one we saw a few years ago. And you may benefit from speaking with a qualified local mortgage loan officer to understand financing options.

You don’t want to fall behind in this market.

So, let's talk about what buyers in our area are paying right now. With a First Federal Bank Loan Officer, and a strategy can help your house gain attention during the early listing period.

When the holidays roll around, travel plans, family gatherings, and all the chaos of the season may make you think it’s better to pull your listing...

Over the past few years, affordability has been the biggest challenge for homebuyers. Between rapidly rising home prices and higher mortgage rates,...

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning tohomeownership....

Manage your accounts, make payments, and more.

Open an account with us.