4 Ways To Make an Offer That Stands Out This Spring

Now that spring is here, more and more buyers are jumping back into the market, and competition is heating up.

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

2 min read

First Federal Bank : February 13, 2026 8:57:07 AM EST

If you’re planning to buy a home this year, you may be focused on the spring market. And hoping that when spring does hit, you’ll see:

But here’s what most buyers don’t realize. Buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Here are three reasons why accelerating your timeline over the next few weeks may be a better play.

A lot of buyers are hoping mortgage rates will fall even further. But that’s not the best strategy. Here’s why. Experts are pretty aligned on this: rates are expected to stay roughly where they are.

Forecasts throughout the industry all point to the same thing: rates are projected to be in the low-6% range this year (see graph below):

(Forecast shown are subject to change and are not a guarantee of future rates). Source: Keeping Current Matters, Mortgage Rates Recently Hit a 3-Year Low, January 2026

That's not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that could mean affordability has already improved more than they may realize.

So why wait a few more weeks just for more buyers to jump in and act as your competition? You already have a window right now. As Chen Zhao, Head of Economics Research at Redfin, explains:

“House hunters should know that this may be near the lowest mortgage rates fall for the foreseeable future.”

Speaking of competition, the spring market is popular for a reason, but with popularity comes pressure. With more buyers active at that time of year, you may have to move faster once you find a home you like. And no one likes feeling rushed.

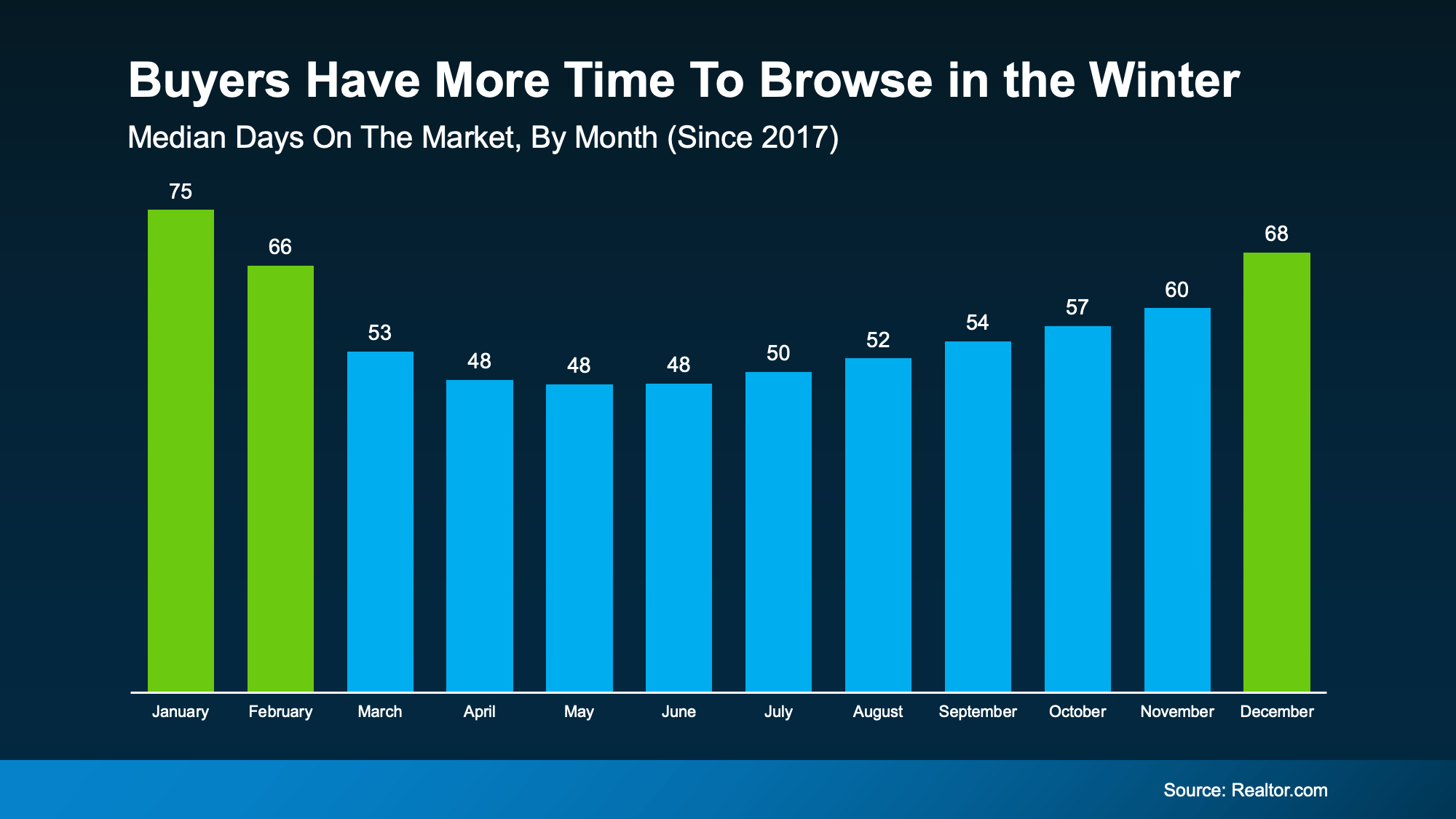

But buy now and you could have more time to browse. Fewer people are looking, so homes sit longer.

You can see this play out in the data from Realtor.com (see graph below). In winter months, it takes an average of about 70 days for a home to sell. In spring? That drops to about 50 days. That’s a 20-day swing – and that pace is going to be more stressful.

Source: Realtor.com. Residential Real Estate Data Library, January 2026

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

And here’s something most buyers forget to factor in. Prices usually respond to demand. So, when demand is higher, prices are too. Bankrate explains:

“Spring and early summer are the busiest and most competitive time of year for the real estate market . . . home prices tend to be steeper to reflect the increased demand.”

In fact, data from the National Association of Realtors (NAR) shows that in 2025, buyers who purchased in the beginning of the year saved roughly $30,000–$35,000 compared to those who bought when prices peaked in the spring or early summer.

(Home prices vary widely by region and property type. Seasonal pricing trends may not apply in every market or year). Source: NAR, Existing Home Sales, December 2025

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

Buying a few weeks before spring isn’t about rushing. It’s about choosing to be ahead of the curve and knowing you want more leverage, less stress, and meaningful savings.

If you’re ready to buy now and want to get the ball rolling, connect with a First Federal Bank Loan officer today!

Now that spring is here, more and more buyers are jumping back into the market, and competition is heating up.

Spring is here, and so is the busiest season in real estate. More buyers are out looking for homes, which means more competition for you. If you want...

Spring is in full swing, and the housing market is picking up along with it. And if you’ve been wondering whether now is the right time to buy or...

Manage your accounts, make payments, and more.

Open an account with us.