Paused Your Moving Plans? Here’s Why It’s Time To Hit Play Again

It’s not really a surprise that 70% of buyers paused their home search last year. Maybe you were one of them. And if so, no judgment. Conditions just...

Manage your everyday finances with convenient accounts, flexible cards, and personalized service designed to fit your life.

At First Federal Bank, we offer flexible mortgage solutions for almost any situation, helping you secure the right financing for your dream home.

Business banking offers secure financial management, streamlined transactions, credit options, and tools to help businesses grow efficiently and sustainably.

2 min read

First Federal Bank : March 21, 2025 8:17:00 AM EDT

Want to know two reasons this  spring might finally be your time to buy? Inventory has grown and sellers may be more willing to negotiate as a result. That means you’ve got more options and more power than buyers have had in years. Let’s break it down.

spring might finally be your time to buy? Inventory has grown and sellers may be more willing to negotiate as a result. That means you’ve got more options and more power than buyers have had in years. Let’s break it down.

The number of homes for sale this February was higher than it’s been in any of the past five Februarys – and that’s great news for your home search. The graph below uses the latest data from Realtor.com to show the supply of homes on the market has grown by 27.5% in just the last year:

More choices for your search is a good thing – and experts also say that inventory is projected to continue rising this year, which is even better. It means it should be easier to find something that checks your most important boxes. But that’s not all this does for you. Danielle Hale, Chief Economist at Realtor.com, explains some of the other perks of more inventory, beyond just having more homes to consider:

“Buyers will not only have more home options . . . but they are also likely to find somewhat lower asking prices and more time to make decisions – all buyer-friendly factors as we inch closer to the busy homebuying season.”

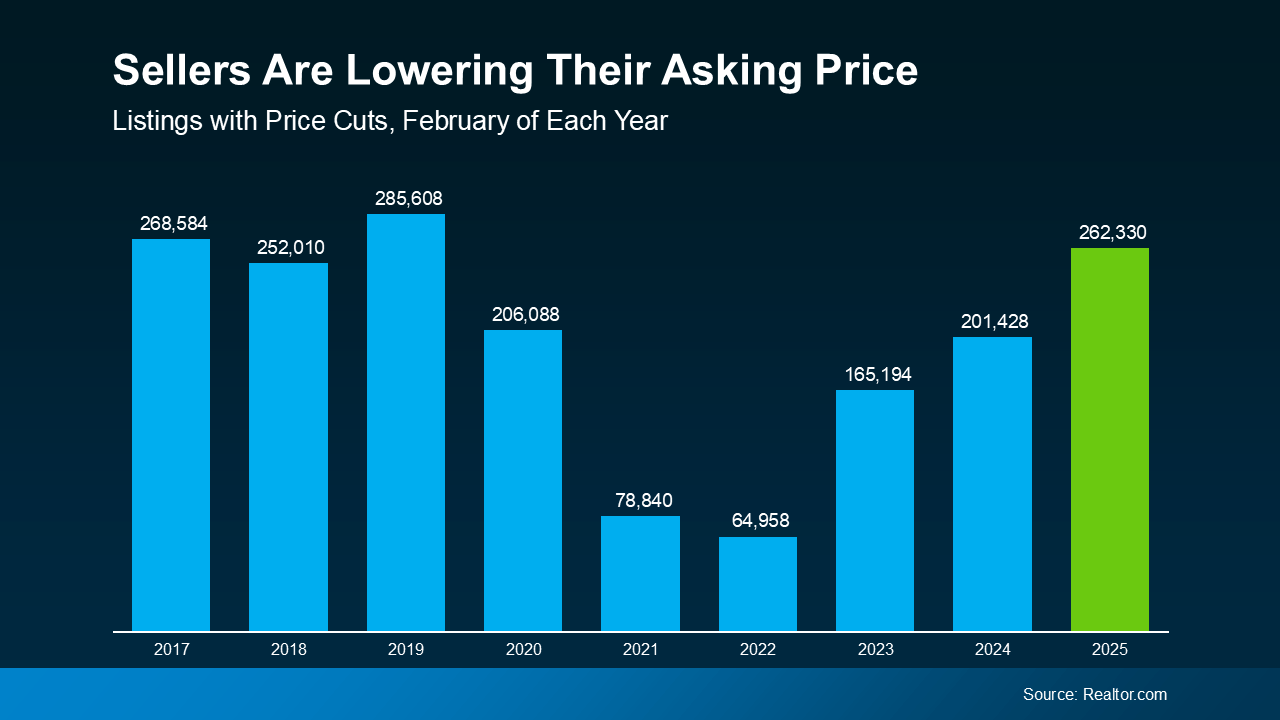

Now that buyers have more options, some homes are sitting on the market a little longer – especially those that were priced too high from the start. And the result is more sellers are having to drop their prices to draw buyers back in. Just take a look at the numbers.

According to Realtor.com, the number of listings with price reductions has gone up compared to the last few years (see graph below):

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

What does that mean for you? It could give you a better chance to negotiate – whether that’s on price, closing costs, or even repairs. While not every seller will adjust their price, more of them are willing to do it – giving you more leverage than buyers have in quite a while.

If you’ve been on the sidelines, waiting for the right time to buy, this spring could be the opening you’ve been hoping for.

Of course, every market is different, and working with a First Federal Bank Loan Officer can help you discover your options.

How does today’s rising inventory impact your homebuying plans?

It’s not really a surprise that 70% of buyers paused their home search last year. Maybe you were one of them. And if so, no judgment. Conditions just...

If you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with a professional.

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to...

Manage your accounts, make payments, and more.

Open an account with us.